This is the 13th edition of the dYdX Epoch Review, presenting updates from the dYdX community and ecosystem. To learn more, join us on Discord, Twitter, and the Community Forums. To make the content more digestible, we have restructured the Epoch Review. The dYdX Foundation team appreciates any feedback from the dYdX community.

A summary of the epoch highlights can be found in this deck and video below.

Key Metrics

Performance Indicators

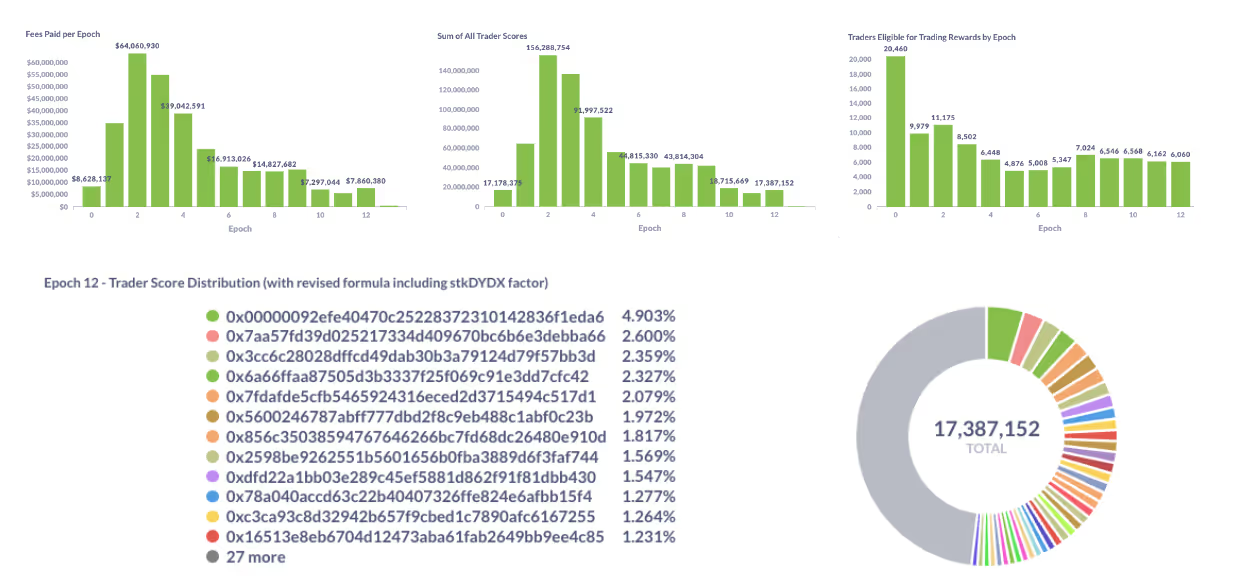

In Epoch 12 (July 5, 2022 15:00 UTC - August 2, 2022 15:00 UTC), no addresses were identified as wash trading, but (*) data excludes activity from 4 addresses identified as wash trading during Epoch 11.

Trading Rewards

3,835,616 $DYDX were earned over the course of Epoch 12 and will be distributed to 6,060 traders. Learn more about the trading rewards program in our documentation, or our recent blog posts.

Source: Metabase Community Dashboard

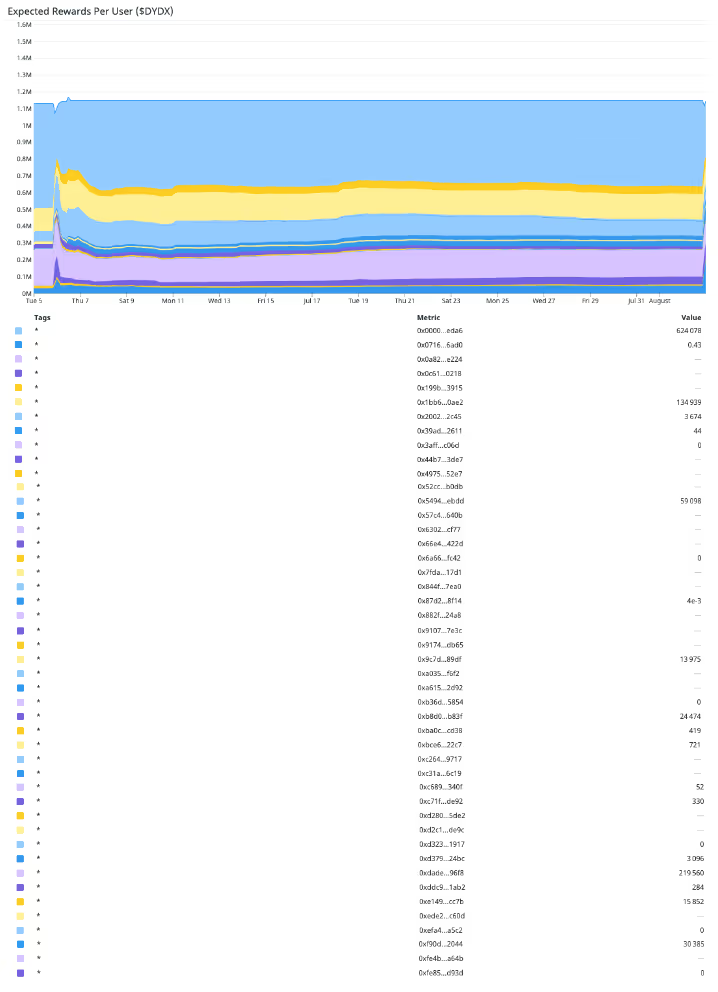

Liquidity Provider Rewards

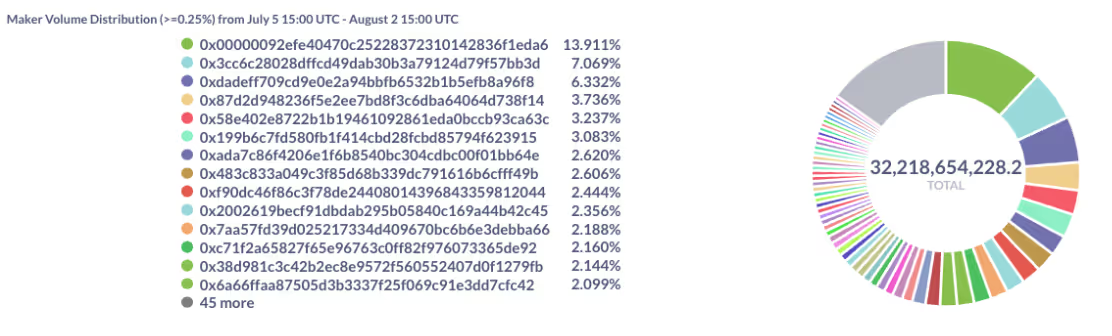

1,150,685 $DYDX were earned over the course of Epoch 12 and will be distributed to 50 addresses that were eligible for LP rewards in Epoch 12. Competition in the pool increased significantly compared to the previous epoch.

Source: Liquidity Provider Rewards Dashboard

Market makers meeting the 0.25% threshold in Epoch 12 are now eligible to earn rewards in Epoch 13. 60 addresses (38 existing and 22 new) did more than =>0.25% of maker volume in Epoch 12. Learn more about the trading rewards program in our documentation, or our recent blog posts.

Source: Metabase Community Dashboard

Liquidity Module

$100M $USDC from 627 users was staked to the Liquidity Staking Pool. This is a significant decrease from the $152M $USDC staked in Epoch 11. The decrease coincides with Snapshot poll to wind down the borrowing pool and turn off rewards generated by staking $USDC to the Liquidity Staking Pool. At the start of Epoch 12, $74M $USDC is actively staked and earning rewards. 44 users requested to withdraw before the Blackout Period in Epoch 12. These inactive USDC funds can now be withdrawn and are no longer earning DYDX rewards. Users must request to withdraw their funds before the Epoch 13 Blackout Window (last 2 weeks of the epoch) to withdraw their funds starting in Epoch 14.

Source: Ethercan

3 market makers have borrowed $22M $USDC from the staking pool. 2 market makers borrowed $110K, while one market maker has borrowed $22M $USDC. The decrease in borrowed funds coincides with Snapshot poll to wind down the borrowing pool. Learn more about the trading rewards program in our documentation, or our recent blog posts.

Source: Dune

Safety Module

35.4M $DYDX from 3,043 users was staked to the Safety Module. This is an increase from Epoch 11 where 34.5M $DYDX was staked. The top 2 stakers account for over 33% of staked $DYDX. 195 users requested to withdraw before the Blackout Period in Epoch 12. These inactive DYDX funds can now be withdrawn and are no longer earning DYDX rewards. Users must request to withdraw their funds before the Epoch 13 Blackout Window (last 14 days of the epoch) to withdraw their funds starting in Epoch 14. Learn more about the trading rewards program in our documentation, or our recent blog posts.

Source: Etherscan

Community Treasury

Approximately 766,703 $DYDX vested in the Community Treasury over the course of Epoch 12. The Community Treasury now holds 34,657,942 vested $DYDX tokens.

In Epoch 5, Reverie officially launched the DGP with 752,000 $DYDX transferred from the Community Treasury to the Grants Committee multi-sig.

In the on-chain DIP, the dYdX community unanimously voted to launch DGP v1.5 with 2,582,000 $DYDX. Learn more about the community treasury in our documentation.

Circulating Supply

12.44% of the total $DYDX supply (excluding unearned Retroactive Rewards transferred to the Treasury and the $DYDX vested in the Community Treasury) is considered liquid at the end of Epoch 12. Learn more about the $DYDX allocation in our documentation.

dYdX Governance

On-chain Votes

- dYdX Grants v1.5: In the on-chain DIP, the dYdX community unanimously voted to launch DGP v1.5 with 2,582,000 $DYDX. This was following the snapshot poll created on July 12, where the dYdX community also voted in favor of launching dYdX Grants v1.5 with $5.5M $DYDX. Read more about the discussion here.

Snapshot Polls

- Simplifying Trading Rewards Formula: On July 31, the community almost unanimously voted in favor of the Snapshot poll to simplify the trading rewards to w=fees and reduce trading rewards by 25%. dYdX Trading has a 1 epoch grace period to implement the formula revision and SLN must submit an off-chain DIP to formalize the change. Reducing $DYDX trading rewards by 25% requires a separate on-chain vote. Read more about the discussion here.

- Adding 15 New Assets: In Epoch 11, the dYdX community almost unanimously supported the Snapshot poll to add 15 new assets to the dYdX exchange. Next, a dYdX community member with 5M $DYDX proposing power must create an on-chain vote to add the new assets.

- Wind down the borrowing pool: In Epoch 11, the dYdX community almost unanimously supported the Snapshot poll to wind down the borrowing pool. Next, a dYdX community member with 5M $DYDX proposing power must create an on-chain vote to wind down the borrowing pool.

Forum Discussions

- Moving the dYdX Borrower Pool to TrueFi: On July 30, TrueFi created a discussion to restart dYdX’s market maker borrowing program and more efficiently onboard new borrowers. The discussion involves launching automated lines of credit on TrueFi where prospective lenders can provide capital to prospective borrowers.

- Revisions to the LP rewards formula: On July 20,SLN Capital posted a DRC proposing revisions to improve the Liquidity Provider (LP) Rewards formula. SLN Capital is proposing to (1) Square the spread term in the LP formula, (2) Adjust weights to v=0.6, d=0.35, s=0.05 for non-BTC/ETH markets, and (3) Adjust weights to v=0.8, d=0.15, s=0.05 or simply v=1.0 for BTC and ETH markets

- Other forum discussions: (1) Starkwhale posted a discussion on improving the current rewards mechanics to encourage greater trader engagement and better protocol health by adding one staked $USDC pool for use as an Epoch rewards credit line. (2) Alucard.eth posted a discussion to create a self-managed community treasury multisig for the purpose of promoting the hedgie ecosystem, (3) Defi_ccwh posted a discussion about a potential partnership with Hummingbot to improve and democratize the process of providing liquidity on dYdX, (4) the dYdX Foundation started a discussion about the adoption of a set of values that are common to the entire dYdX ecosystem, and (5) 0xCLR posted a discussion on a comprehensive risk management framework for all markets on dYdX.

What’s Next?

- Epoch 12 has ended. Welcome to Epoch 13! Epoch 13 started automatically on August 2 at 15:00 UTC and will end on August 30 at 15:00 UTC.

- The Merkle root was proposed on-chain on August 2 at 18:39 UTC and the 7-day waiting period has begun. Epoch 11 rewards will be claimable here on August 9, at 18:39 UTC (7 days after the end of the epoch plus a 3 hour delay). Once tokens have been claimed, they can be transferred, staked to the Safety module, or delegated to dYdX governance.

- The Merkle tree data, which is a list of (address, reward) pairs, is available here. Under the hood, the Merkle Distributor smart contract (0x01d3348601968aB85b4bb028979006eac235a588) will distribute $DYDX token rewards according to a Merkle tree of balances.

dYdX Ecosystem

- DGP update: The dYdX community unanimously voted to launch DGP v1.5 with 2,582,000 $DYDX. DGP v1.5 aims to continue the efforts of DGP v1.0, but in a higher-impact and more targeted manner. Through DGP v1.0, 62 grants were funded for $2.1M across many areas, including research, marketing, education, and trading tools. Read more about the DGP v1.5 here, and access the grants website here.

- Delegation: In Epoch 12, 8 new Endorsed Delegates onboarded. See the full list of Endorsed Delegates here. In addition, the governance burrow started a ‘Meet the Delegates’ series, where delegates were introduced and asked questions by the community. Read about the summary of the episode here. If you hold $DYDX and/or $stkDYDX but have no time to review proposals, gas is too expensive to vote, consider delegating the proposing power and/or voting power of your $DYDX and/or $stkDYDX to one of the 20 Endorsed Delegates.

- Hedgies allocation: dYdX Foundation announced that 9 out of the dYdX Foundation’s 205 Hedgies have found new homes with dYdX community members! Read more about it here.

- Ambassador Program: See the updates from each burrow below.

- User Onboarding & Education Burrow

- Risk Analysis Burrow

- Governance Burrow

- Media Burrow

- Analytics Burrow

- Student Burrow

dYdX Trading Updates

- On August 1, dYdX Trading announced free trading for up to $100k in volume per month to all users across all markets. Read about it here.

- On July 28, reduce-only and bracket orders went live on the dYdX iOS app. Read about reduce-only orders here.

- On July 28, a new Transfer UI was launched which allows the transfer of funds between accounts without leaving the platform. Read more about it here.

- On July 6, dYdX Trading Inc. announced the first Legends Competition – a trading competition for crypto influencers to compete against one another for cash prizes and bragging rights! Check out the Twitter Spaces that dYdX Trading hosted with the participants here. Congratulations to the winners!

New Features

- On July 28, the dYdX academy posted a tutorial video on Reduce-Only orders. Watch it here.

- On July 23, the User Onboarding Burrow created the dYdX Endorsed Delegate Course on dYdX Academy. Access the course here.

- On July 19, the dYdX Academy posted a tutorial video on Take-Profit orders. Watch it here.

- Want to transfer $USDC between accounts without paying gas fees? Read more about the create_transfer API here.

- Gasless deposits are live. The minimum threshold is $500 USDC for your first deposit and $1,000 USDC for subsequent deposits. Read more about it here.

- Want to practice your trades with no risk? Head here and practice today!

- To increase responsiveness about language and localization issues, dYdX Trading Inc. and dYdX Foundation created the 🌎#┃issue-reporting channel on Discord.

- Check out Hedgie Displays - animated derivative NFTs to be used for physical video displays by only the owner of the respective Hedgies NFT.

Social

- On July 29, the dYdX ambassadors started the first POAP hunter event, where the community will have the opportunity to earn up to $500 USDC by collecting as many POAPs as possible. Read about the event here.

- On July 28, Corey Miller, Growth Lead at dYdX Trading, was featured on CoinGecko to discuss dYdX’s migration to Cosmos. Watch the episode here.

- On July 22, the dYdX Foundation released a mid-epoch 12 governance review. Read the tweet thread here and the blog post here.

- On July 21, the governance burrow hosted the first episode of the ‘Meet the Delegates’ series, where AX07 and Alucard were featured. Watch the episode here, and review the summary here.

- On July 21, the dYdX Ambassadors website was launched. The website hosts the latest news surrounding the ambassador program and upcoming events. Visit the website here.

- On July 20, dYdX hosted a podcast episode with CMS holdings on the anatomy of a trade. Listen to it here.

- On July 20, Messari launched a state of dYdX Q2 state of 2022 report. Read the tweet thread here and the full article here.

- On July 15, the analytics burrow shared the official dYdX analytics dashboard.

- The dYdX Foundation is looking to hire a People Operations Coordinator! See the job posting and apply here.

- On July 13, dYdX Trading hosted a Twitter Spaces with Antonio, CEO and Founder of dYdX Trading Inc. The discussion covered V4 product features and technicalities as well as overall company plans moving into the future. Listen to it here.

- On July 13, dYdX Trading released Episode 2 of the Depth and Spread podcast featuring Mitchell Dong, CEO of Pythagoras. Listen to the full episode here.

- Want to learn more about dYdX, DeFi, and much more? Check out the dYdX Academy and watch for updates at 🎓┃dydx-academy on Discord.

- Looking for more information about the dYdX ecosystem? Check out the dYdX DAO info docs here.

- Make sure you RSVP to the following events: Hedgie Huddle, and the Epoch 11 Review and AMA.

About the dYdX Foundation

Legitimacy and Disclaimer

Crypto-assets can be highly volatile and trading crypto-assets involves risk of loss, particularly when using leverage. Investment into crypto-assets may not be regulated and may not be adequate for retail investors. Do your own research and due diligence before engaging in any activity involving crypto-assets.

dYdX is a decentralised, disintermediated and permissionless protocol, and is not available in the U.S. or to U.S. persons as well as in other restricted jurisdictions. The dYdX Foundation does not operate or participate in the operation of any component of the dYdX Chain's infrastructure.

The dYdX Foundation’s purpose is to support the current implementation and any future implementations of the dYdX protocol and to foster community-driven growth in the dYdX ecosystem.

The dYdX Chain software (including dYdX Unlimited) is open-source software to be used or implemented by any party in accordance with the applicable license. At no time should the dYdX Chain and/or its software or related components (including dYdX Unlimited) be deemed to be a product or service provided or made available in any way by the dYdX Foundation. Interactions with the dYdX Chain software (including dYdX Unlimited) or any implementation thereof are permissionless and disintermediated, subject to the terms of the applicable licenses and code. Users who interact with the dYdX Chain software, i ncluding dYdX Unlimited (or any implementations thereof) will not be interacting with the dYdX Foundation in any way whatsoever. The dYdX Foundation does not make any representations, warranties or covenants in connection with the dYdX Chain software (or any implementations and/or components thereof, including dYdX Unlimited), including (without limitation) with regard to their technical properties or performance, as well as their actual or potential usefulness or suitability for any particular purpose, and users agree to rely on the dYdX Chain software (or any implementations and/or components thereof, including dYdX Unlimited) “AS IS, WHERE IS”.

Nothing in this post should be used or considered as legal, financial, tax, or any other advice, nor as an instruction or invitation to act by anyone. Users should conduct their own research and due diligence before making any decisions. The dYdX Foundation may alter or update any information in this post in the future at its sole discretion and assumes no obligation to publicly disclose any such change. This post is solely based on the information available to the dYdX Foundation at the time it was published and should only be read and taken into consideration at the time it was published and on the basis of the circumstances that surrounded it. The dYdX Foundation makes no guarantees of future performance and is under no obligation to undertake any of the activities contemplated herein.

Depositing into the MegaVault carries risks. Do your own research and make sure to understand the risks before depositing funds. MegaVault returns are not guaranteed and may fluctuate over time depending on multiple factors. MegaVault returns may be negative and you may lose your entire investment.The dYdX Foundation does not operate or has control over the MegaVault and has not been involved in the development, deployment and operation of any component of the dYdX Unlimited software (including the MegaVault).

Get Involved with the Community

Become a part of our journey to reshape the financial landscape